should i form an llc for one rental property

If you own many rental properties or have a rental property with an exceptionally high value you could set each under its own LLC. However if you create a real estate LLC.

How Do I Transfer Title Of A Property From A Person To An Llc Legalzoom

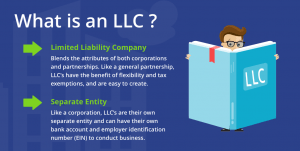

Rather than holding rental property as a sole proprietorship as an individual a real estate investor may consider forming a single-member LLC to hold investment property.

. Choosing between an LLC or S corp for rental property can be difficult. For instance lets say your online. I have 8 rental properties should I apply for an LLC.

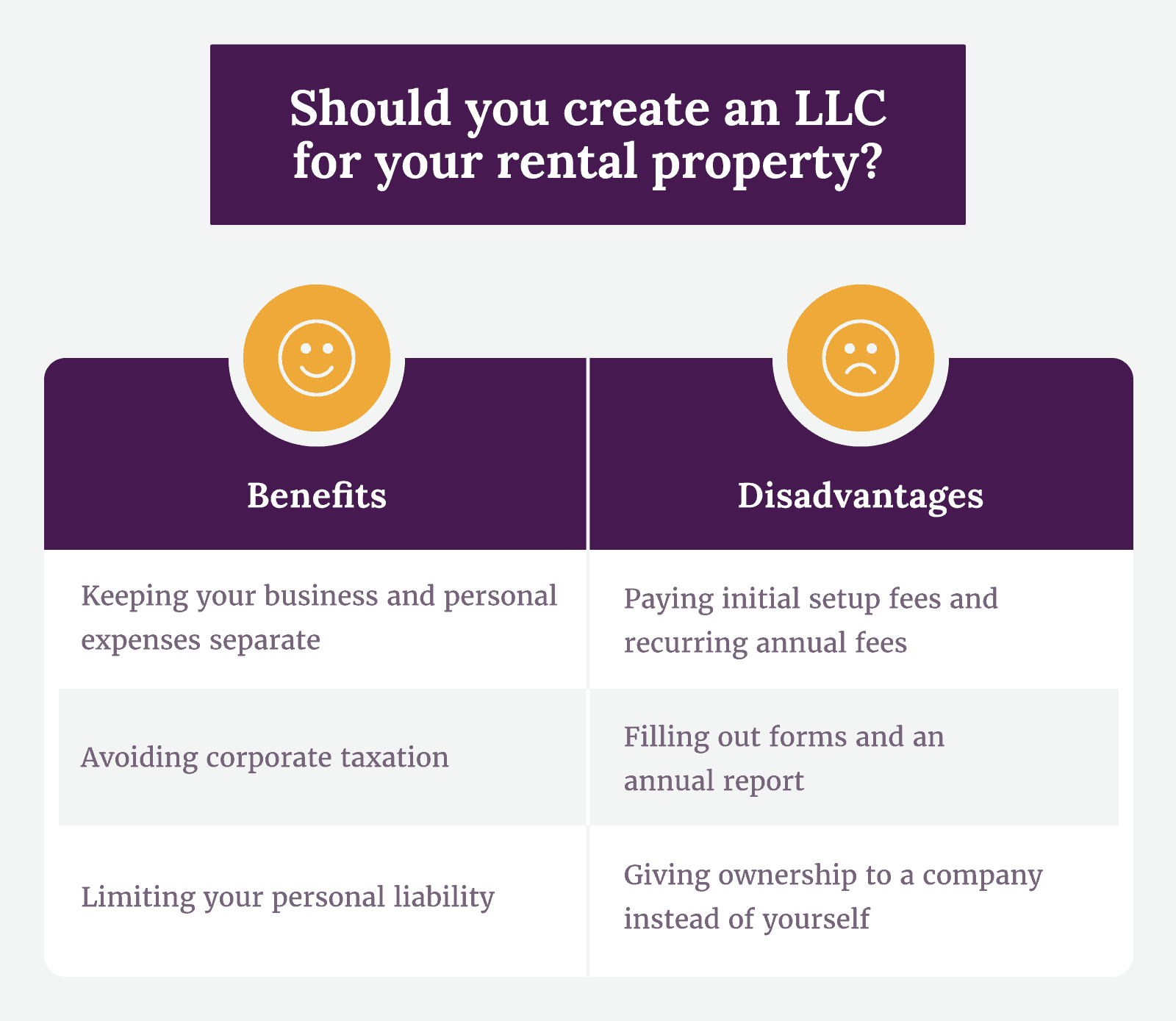

If you own rental property and a tenant files a lawsuit against you the lawsuit could bring any number of personal assets into the case. 2 You have protection from lawsuits personally. Here are a few of the disadvantages of creating an LLC for rental property.

Higher Interest Rates If you are planning on financing the rental property you may not have to spend. With one property deed per LLC you can manage multiple properties without risking all of them as collateral if. Avoiding Personal Liability This is the major advantage of an LLC.

Yes you want to file for a LLC for the following reasons 1 You subject to tax write-offs for all the money you spend for opertaing of the property. By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party. Go through the proper channels to create a company.

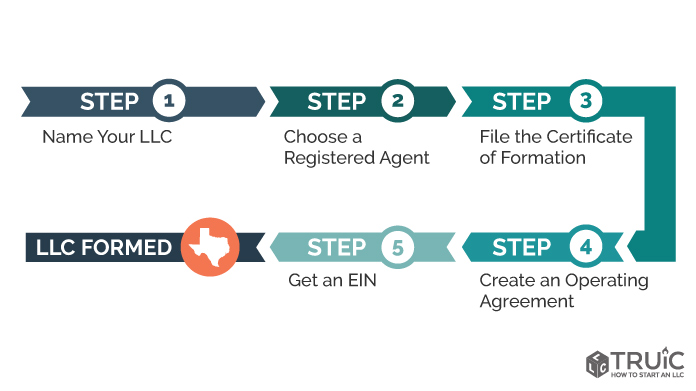

If youre thinking about investing in real estate and then renting one of your properties you should consider forming an LLC or a limited liability company to hold the titles. Though it may cost exponentially more some landlords prefer to set up a separate LLC for each rental property. To form an LLC you will need to complete a few steps.

The personal pucker factor is a suggestion that instead of forming an LLC for every single property you form a selection of LLCs with several properties in each. Complete and submit the required paperwork. This would prevent any legal issues of one.

Make sure you have the. If you have all 8 properties in one LLC a. The top reason to put your rental properties into an LLC is to protect your other assets.

Here are the pros and cons of forming an LLC for real estate investments. They would be forced to bring. You want the best option for.

The protections that are inherent to the LLC will then apply to. Generally an LLC is typically better for rental properties than an S corp. Lets look at an example.

Your tenant trips and falls down the stairs suffering a serious injury. LLCs can be a great way to protect yourself and your assets and as an owner of several rental properties in various states Ive pondered this question myself. You can also form an LLC for each rental property that you hold.

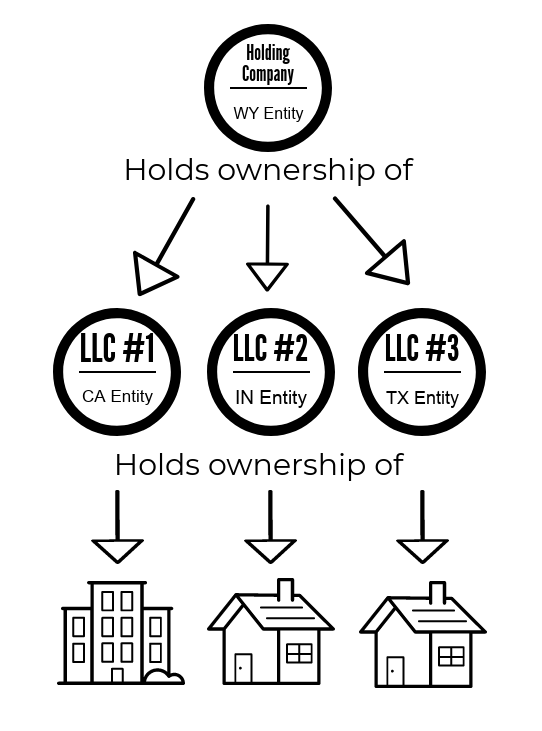

You should apply for 8 LLCs and I would recommend another to hold ownership in all of them. With one property deed per LLC you may handle a number of properties with out risking all of them as collateral if one in all them fails.

Llc For An Investment Property Real Estate Attorney Near Me

Is Rental Property A Good Investment For Most Ezlandlordforms

/for-rent-sign-in-front-of-new-house-149060607-c867727981a64793983ff5e68a1498f6.jpg)

Real Estate Trust Or Llc Helping Landlords Choose

How To Get A Mortgage For Llc Owned Properties

How To Create An Llc For A Rental Property With Pictures

Landlord Llc Should Landlords Form One For Rental Property

Llc In Real Estate Pros And Cons Nestapple New York

How To Create An Llc For A Rental Property With Pictures

How To Create An Llc For A Rental Property With Pictures

Llc For Rental Property Should You Put Rental Property In An Llc Youtube

Should I Create An Llc For My Rental Property Pros Cons

Starting An Llc For Real Estate What You Need To Know

It S Complicated Switching From Home Ownership To Llc Can Be Tricky

Should You Create An Llc For Your Rental Property Allbetter

Should You Put Your Rental Properties In An Llc

Llc For Rental Property Pros Cons Explained Simplifyllc

Should You Put Rental Properties In An Llc Umbrella Llc For Real Estate Passive Income