property tax assistance program florida

The Homestead Property Tax Deferral Program can give you extra time to pay property taxes on your primary residence home. Principal address is 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312.

Property Tax Calculator Smartasset

Check Form 1098 from your mortgage company.

. This reduces the taxable. We can check to see if you have explored all assistance possibilities. SUITE 3 TALLAHASSEE FL.

HAF is a federally funded program established under Section 3206 of the American Rescue Plan Act of 2021. It was incorporated 3 years ago on 6th. Bronough Street Suite 5000 Tallahassee Florida 32301 Phone.

The meeting location to be held in the conference room located at the Division of Community Assistance office in the Reflections Plaza at 520 W. These include a tax deadline extension coronavirus relief for rent and mortgage payments student loan relief and enhanced unemployment benefits. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

Has the Florida company number L18000163659 and the FeiEin number NONE. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes. Contact Us Florida Housing Finance Corporation 227 N.

Lake Mary Boulevard Suite. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

The homestead exemption and Save Our Homes assessment. A Housing Credit allocation to a development can be used for 10 consecutive years once the development is placed in service and is designed to subsidize either 30 percent the 4 percent. The STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. Eligible homeowners could receive assistance with mortgage. The Portability part of Floridas Homestead Laws let you move your accrued Homestead savings up to a maximum of 500000 to any subsequent home in Florida.

There are some easy ways to figure out how much youve paid in property taxes. You will have to. The Property Tax Oversight PTO program is experiencing technical difficulties with the telephone system.

Is an Inactive company incorporated on July 6 2018 with the registered number L18000163659. Look Into a Hardship Program. It does not cancel the property taxes you owe.

Was incorporated on Jul 06 2018 as a FLLC type registered at 1400 VILLAGE SQUARE BLVD. Box 10 will contain the information detailing. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

If you or someone you. If you have already exhausted assistance we can also help you by purchasing your property quickly before you. Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several.

Taxes United Way Of Palm Beach County

Florida Ok S Property Tax Breaks Following Surfside Collapse

Florida Homestead Check Florida Residential Property Tax Experts

Charlotte County Tax Collector Property Tax

.png)

Vita Free Tax Prep Assistance United Way Of Charlotte County

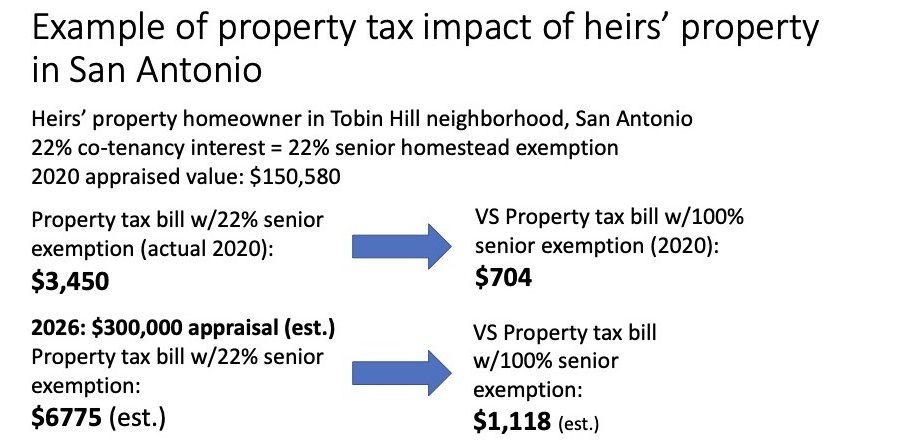

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Property Taxes Monroe County Tax Collector

Florida Property Tax Presentation

Indian River County Auditor Homestead Exemption

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Florida S Sales Tax Holidays Tax Breaks Bring Benefits Opinion

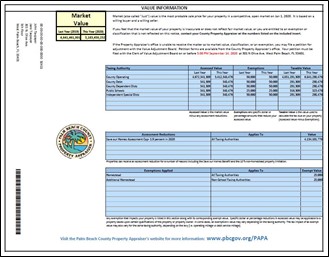

The Palm Beach County Property Appraiser S August 2021 Newsletter City Of Westlake Florida

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

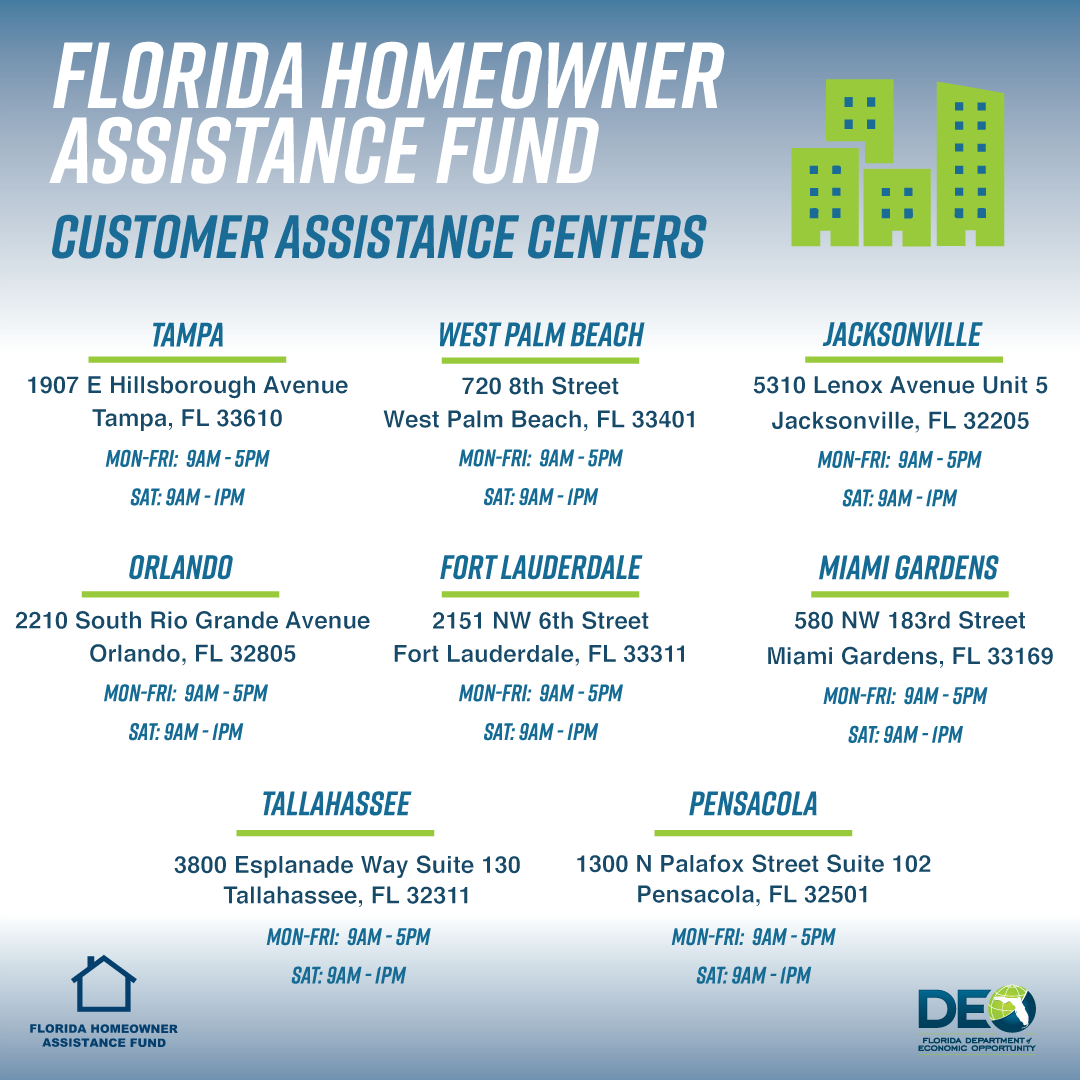

The Florida Department Of Economic Opportunity S Homeowner Assistance Fund Reaches Key Milestone Awarding More Than 100 Million To Assist Florida S Vulnerable Homeowners

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media